|

| Insurance went way up due to info (Page 3/4) |

|

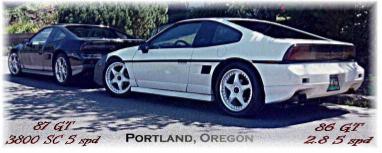

87GT3800SC5SPD

|

FEB 16, 02:14 PM

|

|

When I opened the State Farm app on my phone yesterday to pay my bill, I was greeted with a message to enjoy all of the features of the app by activating location to "find agents, etc".

Although I have tracking turned off for most apps, the last people I would want tracking me is an insurance company.

My current 6 month premium is $346 for full coverage with lowest deductibles, in a low rural area. I have a crappy agent, but after 50 years of coverage with State Farm, I have not found better rates beyond introductory rates, that don't last beyond 6 months.

I have had my one remaining 87 "6cyl" Fiero GT for 26 years.------------------

Bill Levin

|

|

|

richard in nc

|

FEB 16, 06:08 PM

|

|

| quote | Originally posted by Raydar:

I'm tired of State Farm. I'm about to insure all three of my Fieros with Hagerty, if they'll accept them. |

|

you will need a garage.

|

|

|

fierofool

|

FEB 16, 09:33 PM

|

|

|

How about Grundy? Does anyone use them?

|

|

|

armos

|

FEB 16, 11:07 PM

|

|

| quote | Originally posted by Vintage-Nut:

State Farm also offers a Usage-Based Insurance Program called "Drive Safe & Save" if you're willing to be monitored. This program combines a telematics device and smartphone app, giving you a discount of up to 30 percent.

|

|

I did a similar monitoring thing with Progressive. I thought I could win that game, but I lost.

You have to drive in an unnatural, often unsafe manner in order to appease a machine with very simple rules. It has no idea what's actually going on.

The worst are the "hard braking" demerits. Every stop sign turns into a naval docking maneuver because if you brake harder than your grandmother on snow, it's "hard braking".

Avoid complete stops. "California stops" are much safer. That last little bit that actually *stops* the car is usually what nails you.

Somebody in the crosswalk ahead? You're probably screwed. But if the crossing is open to negotiation, then roll on to protect your insurance score.

When driving on hwy27 around here, every stale green light made me nervous. If a light changes at the wrong moment, you're screwed. Your only hope is finding a perfect balance of braking pressure that won't cross the insanely low "hard braking" threshold, but will still stop you in time. Sometimes it can't be done.

I also got a couple "fast acceleration" strikes. They can trigger in the first few feet, even if you let off while still going very slow. If the phone feels anything, it's too much. At higher speeds it's not as picky.

My score bounced between "A" and "B", but after my last idle-5mph drag racing strike, it went the last month refusing to ever bring my score back up.

For a B it wasn't worth the aggravation. I don't know if they've gotten any better. If they'd shut off the sensitivity at single-digit speeds it would be a lot more manageable.

I wonder if there's cell phone apps that show the accelerometer thresholds and how close you are to hitting them.

|

|

|

hyperv6

|

FEB 17, 12:01 AM

|

|

|

Florida also has seen the rise of car insurance. Storms have damaged so many cars and homes they yanked tge rates right on up.

|

|

|

cvxjet

|

FEB 17, 12:28 AM

|

|

When I first started driving back in 1977, I was on my father's insurance....then I got a ticket and my father stated "You're on your own!"

The insurance rate for a year was $500 on my Merc Comet GT....I called the agent and told him, among other things, that although they had my car down as a "V8 sedan" I had upgraded the performance- my basic theory being that if the car handled better, stopped better and accelerated better, I could do a better job of avoiding accidents...

That agent, Bob Jones, was extremely religious and actually agreed with my basic statement- and he was able to drop my rate down to $340....

I have always been honest- with my GFs, my friends, neighbors and even my bosses- and have gotten in a lot of trouble because of that- this time with my insurance agent was one of the few times it actually helped my situation...

|

|

|

PhatMax

|

FEB 17, 09:04 AM

|

|

Geez, I pay $1900 for 6 months….but there’s a Nissan truck, 78 Firebird, 2017 Highlander and my house insurance on it.

Full coverage on everything. The Bird is covered for 10k

|

|

|

Raydar

|

FEB 23, 03:30 PM

|

|

There was a link to Lexis-Nexis, which allows you to order a copy of your file. (No doubt sanitized for "consumers".)

So I did. It's interesting.

Only a few surprises...

1. They listed the address of the house I grew up in, which I sold in 1996. But missed several places that I had rented, over the years.

2. They only had my old landline #, which was cancelled in 2021. None of the other landlines or cell numbers I've had/still have.

3. They listed most - but not all - of the cars that my wife and I have owned since we got married.

4. Every time I logged into Credit Karma, it added a line to the list of "inquiries" (not sure if that's the correct term or not.) It apparently doesn't count as a "hard inquiry" - like a credit check - however.

5. Although it has my street address and city correct, it has my county of residence shown incorrectly. (I plan to have that corrected.)

But yeah. Lots of stuff. They link you to a downloadable PDF. Mine was 54 pages!

If you feel so inclined, go to the link and order. Learn some stuff about yourself.  [This message has been edited by Raydar (edited 02-23-2024).]

|

|

|

Raydar

|

FEB 23, 03:40 PM

|

|

| quote | Originally posted by richard in nc:

you will need a garage.

|

|

Not a problem.

|

|

|

ceverhart

|

FEB 24, 08:20 PM

|

|

| quote | Originally posted by fierofool:

How about Grundy? Does anyone use them? |

|

I have my 2002 Trans am with Grundy, needs garaged 15k value, no deductible 240 a year. My normal cars are with State Farm but I will be shopping for new insurance soon...rates increase every 6 months. I used to be with progressive but they raised my rates 23%, when I called and got a supervisor ror an explanation I was told that due to losses recently all rates had went up. They chose a bad time to lie...My wife had her own policy at the time with our kid on it...and her rates went down 14% at the same time. I cancelled my policy that night. In less than 3 years my State Farm bill has went from $140 a month for full coverage on 4 cars to $213. We have had no loss reported, no speeding tickets or moving violations.

|

|

|

|