|

| The EV Transition is Harder Than Anyone Thinks (Page 4/5) |

|

Cliff Pennock

|

AUG 28, 06:05 PM

|

|

| quote | Originally posted by Patrick:

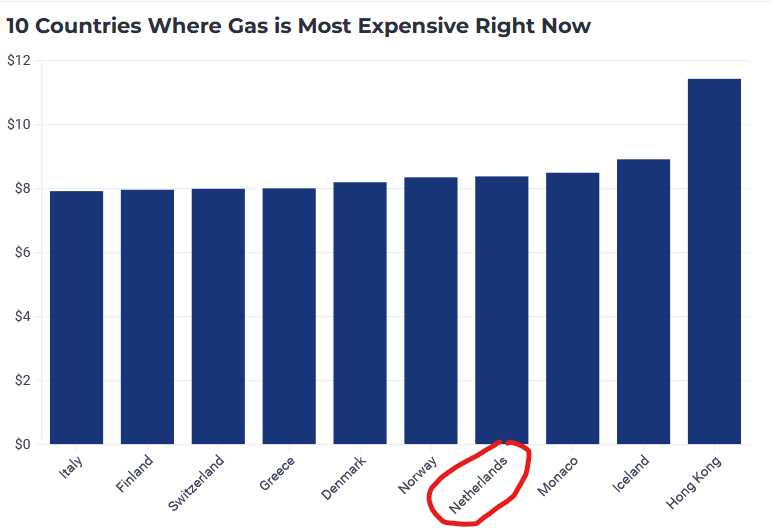

Be grateful you don't live in Hong Kong where gas is already over $11 a gallon!  |

|

Sucks to be us...

|

|

|

theogre

|

AUG 28, 11:24 PM

|

|

Sales Numbers are BS because most to all "reports" include China that Lies about all numbers...

| quote | Originally posted by Cliff Pennock:

| | CLICK FOR FULL SIZE |

Sucks to be us... |

|

Many to most of the EU has no-one to blame because keep voting for govrmnts that Raises Fuel Prices for Decades by High Taxes.

Summery Gas taxes in Europe (2022) @ the Pump...

Netherlands (NL) Per Litter €0.82, US Gallon equiv $3.69

https://taxfoundation.org/d...axes-in-europe-2022/

Even w/ the US taxes in the price I paid < $ then that for gas this week.

Also Unlike US w/ mostly have Fix Fuel Tax from Fed and State level, Many EU and other countries many Taxes are % based so Fuel/Road Taxes & VAT raise or falls when Retail Fuel Price changes. (In super short, VAT, Value-Added Tax, is Equiv to Sales Tax in most of the US.)

Note that the link story and most others ignores Taxes on the "back end" for Refiners etc that they just raise the Retail Price to make up the lose.

IOW same scam PA pushed Taxes on Refiners etc ~ 10 years ago that just pass down to Retail buyers on top of High State Fuel/Road taxes at the pump. But PA buyers don't get a "Double Whammy" as state and fed Fuel taxes are fixed.

|

|

|

Australian

|

AUG 29, 04:16 AM

|

|

|

To mine lithium you need to find it first and to get it destroy water tables. Politicians say things for votes only when everyone is freezing or stuck they will realize last generation were better off. The people buying electric cars lease them and turn over cars every few years they aren't fixing grandads 27 Buick keeping the carbon footprint down. The term invented by oil company to spread out the blame. If climate change is the new religion, then why lease an EV when you supposed to hold hands singing we are the world and keep it forever.

|

|

|

rinselberg

|

AUG 29, 11:33 AM

|

|

Direct Lithium Extraction or "DLE"... more lithium without lowering the water table? It's a possibility.

| quote | Projections for lithium demand in support of energy transition efforts have made discussions about likely shortages ubiquitous. Such shortages would be a potential limiting factor for batteries for electric vehicles, wind turbines, and energy storage, among other uses. The International Energy Agency’s (IEA) analysis of critical minerals estimates that (in some scenarios) the demand for lithium may increase 40-fold by 2040. At the same time, IEA warns that we could see lithium shortages as early as 2025.

Today, most conventional lithium mining is done by means of lithium brine extraction—whereby drilling into salt flats and letting the brine evaporate in ponds can take months to years—or hard rock mining—which is overall much more energy intensive and costly. There is only one, relatively small, operational lithium mine in the United States, in Silver Peak, Nevada. The mine, owned by Albemarle, uses a lithium brine extraction process.

But oil and gas companies are exploring a relatively new approach that could cause lithium mining to take off: direct lithium extraction (DLE). DLE takes the extracted lithium brine into a processing unit, which filters out lithium and then reinjects the brine—without the lithium—back into the aquifer. This technology shortens the lithium extraction process to only a few days or even hours. Potential DLE areas in the U.S. include the Smackover Formation (Arkansas), the Salton Sea (California), the Great Salt Lake (Utah), and Permian Basin.

Although there are pilot projects in both China and Argentina, large-scale DLE is still largely an unproven technology. Yet its potential is promising. Goldman Sachs likens the impact of DLE to that of fracking on oil extraction and calls DLE “a potential game-changing technology.” (We like the analogy!) DLE is hotly anticipated for its increased efficiency, including decreased energy rates, higher recovery rates, and conservation of 98 percent of extracted water. The technology can be applied to spent oilfields.

Like any new technology, DLE has some obstacles to overcome. It needs additional pilot studies to ensure true functionality, quantification of the full process’s energy consumption, and increased environmental and general monitoring guidelines. In addition, to maximize lithium mining’s full potential, the process could be used to extract other useful minerals.

Exxon has recently purchased drilling rights for 100,000 acres in the Smackover Formation and foreshadowed drilling for lithium in the coming months. Oxy Low Carbon Ventures created a partnership with All-American Lithium to form Terralithium; the subsidiary combines DLE and direct lithium hydroxide conversion to develop a “cost effective and more responsible lithium hydroxide production approach that’s easier on the land and natural resources.” We expect smaller companies to either participate as junior partners or wait and see before jumping in. |

|

Tisha Schuller and Laura Horowitz for Adamantine Energy; August 17, 2023.

https://energythinks.com/li...nto%20the%20aquifer.

[This message has been edited by rinselberg (edited 08-29-2023).]

|

|

|

Wichita

|

AUG 30, 07:05 PM

|

|

Ford just announced that they will be ending their gas powered Escapes, Edges and Transit Connects to make room for EV models.

The last gas powered Fiesta rolled out the assembly line just last month.

As much as we can debate this, the market is speaking and it is fully pot committed to EVs.

As I have mentioned before, you won't be able to buy a new gas powered car by the end of this decade, because none will be built

|

|

|

rinselberg

|

AUG 31, 02:30 AM

|

|

"Right On" Jack... uh, Wichita. And it's the Inflation Reduction Act which I signed into law just over a year ago, along with some of the other Biden and Democrat-backed federal legislation and funding, that is playing a major role in making this relatively rapid electrification of America's passenger and light duty road vehicles a reality.

Here's some of what my friend Paul Krugman had to say exactly two weeks ago in an op-ed column for the New York Times:

| quote | A year ago, defying predictions that President Biden’s agenda was dead in the water, Congress passed the Inflation Reduction Act. The I.R.A. is sort of the Holy Roman Empire of legislation—as in being neither holy, nor Roman, nor an empire. That is, it isn’t actually about reducing inflation; it’s mainly a climate bill, using tax credits and subsidies to encourage the transition to a low-emission economy.

And it’s a big deal. Along with the CHIPS Act—Creating Helpful Incentives to Produce Semiconductors—the federal government is suddenly engaged in large-scale industrial policy, promoting particular sectors as opposed to the economy as a whole. . . .

[This] new industrial policy has already generated a huge wave of private investment in manufacturing, even though very little federal money has gone out the door so far. Why?

A new blog post from Heather Boushey of the Council of Economic Advisers argues that Biden’s industrial policy helps solve what she calls the “chicken and egg problem,” in which private-sector actors are reluctant to invest unless they’re sure that others will make necessary complementary investments.

The easiest example is Electric Vehicles: Consumers won’t buy EVs unless they believe that there will be enough charging stations, and companies won’t install enough charging stations unless they believe that there will be enough EVs. But similar coordination issues arise in many other areas, for example in the complementarity between battery and vehicle manufacture.

Even before seeing Boushey’s post, I’d been thinking along similar lines. In particular, the ongoing investment surge reminded me of a once-popular concept in development economics, that of the Big Push. This was the argument that you needed an active government role in development because companies wouldn’t invest in developing countries unless assured that enough other companies would also invest. . . . |

|

"Biden and America’s Big Green Push"

Paul Krugman for the New York Times; August 17, 2023.

https://www.nytimes.com/202...ndustrial-trade.html[This message has been edited by rinselberg (edited 08-31-2023).]

|

|

|

rinselberg

|

AUG 31, 02:58 AM

|

|

Picking up where I just left off, this is what Krugman means when he talks about "Biden and America's Big Green Push."

"Ford to build $3.5B Michigan battery factory with Chinese [technology]"

| quote | | [Even amid] growing US-China tensions, Ford will build a $3.5 billion Michigan plant [using] technology from China-based Contemporary Amperex Technology Co. Limited (CATL). |

|

| quote | | "It's really important to understand that Ford controls the plant," Lisa Drake, VP of EV industrialization at Ford, told The Washington Post. CATL personnel will help set up, but "we will operate the facility. It will be a Ford plant manager," she said. |

|

| quote | | Ford will soon offer two EV battery chemistries, each with unique benefits: the lower-cost LFP offers more durability and charging tolerance, while nickel cobalt manganese (NCM) provides more energy and power, and performs better in cold weather. |

|

Stephanie Mlot for PCMag; February 14, 2023.

https://www.pcmag.com/news/...ry-with-chinese-tech

|

|

|

Cliff Pennock

|

AUG 31, 03:07 AM

|

|

| quote | Originally posted by OldGuyinaGT:

Also, I though about putting this under the 'Politics and Religion' heading, but the information I'm trying to make available is mostly apolitical, and is more technological |

|

And yet, some people jump at the opportunity to turn this into yet another political debate... 🙄

|

|

|

MidEngineManiac

|

AUG 31, 05:10 AM

|

|

Simple reality check on these things.

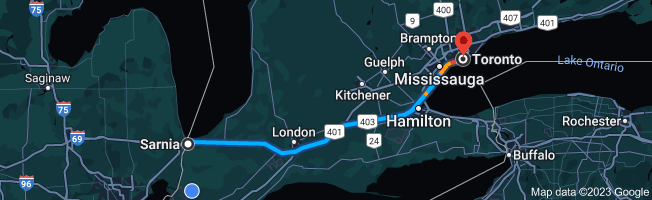

Here is a return trip I used to make twice a week. Fossil-fuel, no problem.

EV would get me there but I am not coming back the same day, and not making many stops while I am there. Making an EV totally useless.

Now look up the sheer traffic volume on that corridor. people doing trips like that every day. (Windsor-Toronto is the same). My longest overnight runs (not that often) were a full day drive each way. It could all be done in 2 long days. Switch to EV and it would take a week to get the same work done. Who wants to pay 2 1/2 times as much for the same thing (service/product ect) ? Because for me to work 2 1/2 times as long is going to take AT LEAST 2 1/2 times the pay, and same with everybody else.

Thats just one area and route. There are hundreds if not thousands like that in North America.

EV's might be fine in large parts of Europe, and inside some North American mega-cities, but for the rest of us it just aint-a-gonna happen short of building 15-minute cities 15 minutes apart. I dont see that happening very soon either.[This message has been edited by MidEngineManiac (edited 08-31-2023).]

|

|

|

rinselberg

|

AUG 31, 06:58 AM

|

|

I am going to project a MidEngineManiac scenario based on a round trip, starting in Toronto, going all the way to Sarnia, and returning to Toronto.

That's a round trip of 360 miles. Plus that up with an additional 140 miles for side trips, for an even 500 miles total.

I am going to picture him in a light duty electric truck like the Ford F-150 Lightning. I picture him carrying some weight in the pickup bed, but not towing a trailer.

I further project that his light duty electric truck will be equipped with a fast-charging lithium iron phosphate or "LFP" battery using the latest "Shenxing" battery design, as it's being developed by China's Contemporary Amperex Technology Company or CATL—a world leader and a "world beater" in battery technology.

I estimate that he will need two 10-minute hookups at a fast recharging station, one to "fill up" for the trip, and one to "fill up again" when he's driven about 250 of the projected 500 total road miles. He will be able to recharge that quickly in weather that's down to 14F or -10C.

So, perhaps not today, but is it unrealistic to think that this will be a realistic scenario for someone like MEM in the very near future?

"CATL debuts fast-charging LFP battery that adds 248 miles In 10 minutes of recharging time"

| quote | | Unveiled today in Beijing, CATL's Shenxing battery is expected to enter mass production in China by the end of the year. |

|

Dan Mihalascu for Inside EVs; August 16, 2023.

https://insideevs.com/news/...%20as%2014%E2%84%89.

"2023 Ford F-150 Lightning"

Drew Dorian for Car and Driver.

https://www.caranddriver.com/ford/f-150-lightning[This message has been edited by rinselberg (edited 08-31-2023).]

|

|

|

|