|

| Credit Card Rates and why they are through the Roof plus other issues. (Page 1/2) |

|

blackrams

|

NOV 24, 01:46 PM

|

|

Janet Yellen departs from office — as she leaves a trail of mess behind her

https://www.msn.com/en-us/m...db778c7b93dccd&ei=14

| quote | The whiplash-inducing, “Hunger Games”-style race to become Donald Trump’s Treasury secretary made it easy for the media to ignore what has been going on with Janet Yellen — and the absolute mess she’s leaving for her successor.

Yellen — who, it was revealed Friday, will be replaced as Treasury secretary in January by hedge fund mogul Scott Bessent — was Joe Biden’s pick to run the office that is essentially the country’s CFO.

Indeed, it could be the most important cabinet position in the White House given the importance of the US economy. Americans put Trump in office largely over his handling of the economy during his first term — job growth and wages that kept place with a low inflation rate.

Despite her gold-plated résumé, Ivy League degrees, and time served as Fed chair, Yellen gave the country just the opposite. Her boss paid the price politically as the American people paid the price economically.

And according to my sources, the American people aren’t done paying the price for Yellen’s mismanagement even if most of the financial media is overlooking the fiscal time bomb she devised — one that could blow up once Trump takes office.

Specifically, my sources who follow the bond market say Yellen has been setting a trap for the incoming Trump administration through the way she financed the massive $1.8 trillion federal budget deficit that exploded during the Biden years with the accumulation of $36 trillion in debt.

Yellen has been moving away from long-term debt to finance the shortfalls to shorter-dated securities, essentially rolling over deficits with more and more Treasury bills instead of the normal way of debt issuance through 10- and 30-year debt.

That’s according to an analysis by Robbert van Batenburg of the influential Bear Traps Report, who estimates that around 30% of all debt is the short-term variety — aka 2-year and shorter notes — compared to 15% in 2023.

Didn’t lock in low rates

In an era of low interest rates, Yellen & Co. could have locked in relatively cheap interest payments for years by issuing more 10- and 30-year debt.

So why go there? Politics, according to Yellen’s Wall Street critics.

Because the Biden administration has taken spending to new and some say unsustainable levels, Yellen needed to engage in a bit of financial chicanery to keep interest rates low and not spook the stock market during an election year, her critics say.

If she had financed deficits with 10- and 30-year bonds, that would have caused a rise in interest rates that impact consumers, i.e. mortgages and credit cards. |

|

All that debt the Biden/Harris and Dems caused is going to be painful both near and long term. The new administration has some very large hurdles to get over. All due to you know who and their policies.

------------------

Rams

Learning most of life's lessons the hard way. .

You are only young once but, you can be immature indefinitely.[This message has been edited by blackrams (edited 11-25-2024).]

|

|

|

maryjane

|

NOV 25, 10:39 AM

|

|

Trying to read this biggered up thread is painful too.

"Why so wide Clyde?"

|

|

|

blackrams

|

NOV 25, 02:22 PM

|

|

| quote | Originally posted by maryjane:

Trying to read this biggered up thread is painful too.

"Why so wide Clyde?" |

|

I have absolutely no idea on why or how that happened. Pretty sure it isn't operator error in that I didn't do anything different than previous postings. But, if there's blame to be had, I'm ready.  Oops, apparently I clicked on the wrong thing. Oops, apparently I clicked on the wrong thing.

It's a good thing I only make one mistake a year. Now that's it for the year. I can quit sweating it. Ya think.

Rams[This message has been edited by blackrams (edited 11-25-2024).]

|

|

|

Patrick

|

NOV 25, 03:11 PM

|

|

| quote | Originally posted by blackrams:

Pretty sure it isn't operator error in that I didn't do anything different than previous postings.

|

|

Pretty sure you clicked on Code instead of Quote when you made that post.

|

|

|

blackrams

|

NOV 25, 03:51 PM

|

|

| quote | Originally posted by Patrick:

Pretty sure you clicked on Code instead of Quote when you made that post.

|

|

Edited: OK, found the error and yes, it was operator error. Fixed it. My sincerest apologies to those who tried to read that posting.

Patrick, thanks for pointing that out. I learned something today so, it's not a wasted day.

Rams[This message has been edited by blackrams (edited 11-25-2024).]

|

|

|

maryjane

|

NOV 25, 07:52 PM

|

|

| quote | Originally posted by Patrick:

Pretty sure you clicked on Code instead of Quote when you made that post.

|

|

Yep, & it even said so, right at the top of his original post. I just couldn't figure out why he would do that, but assumed he had a reason.[This message has been edited by maryjane (edited 11-25-2024).]

|

|

|

Patrick

|

NOV 25, 08:38 PM

|

|

| quote | Originally posted by maryjane:

I just couldn't figure out why he would do that...

|

|

The Code tab is right beside the Quote tab. A zig instead of a zag with the cursor... and voilà.

|

|

|

blackrams

|

NOV 25, 08:59 PM

|

|

| quote | Originally posted by maryjane:

Yep, & it even said so, right at the top of his original post. I just couldn't figure out why he would do that, but assumed he had a reason.

|

|

Well, it could be I was just trying to get your attention.

Rams

|

|

|

82-T/A [At Work]

|

NOV 27, 08:50 PM

|

|

You know, in my last job... I was making decent money, and I was doing OK. I had no debt and things were good... that was 2021. With the cost of living, as it happened over the next 2-3 years... it's completely insane. There is absolutely no way I'd be able to live / afford to live on the salary I was making then. I quit and took another job, a much higher paying one because of my previous experience (which was considered valuable), but most people cannot do that. Most people who were making whatever they were making in 2021, are still making that same amount. Maybe they got a 5% raise every year, when the cost of living went up 30% year over year.

It's absolutely insane to me... and then Democrats are upset that families voted for the economy, saying stupid things like... "I hope you like your price of groceries while I lose my rights" (or some nonsense).

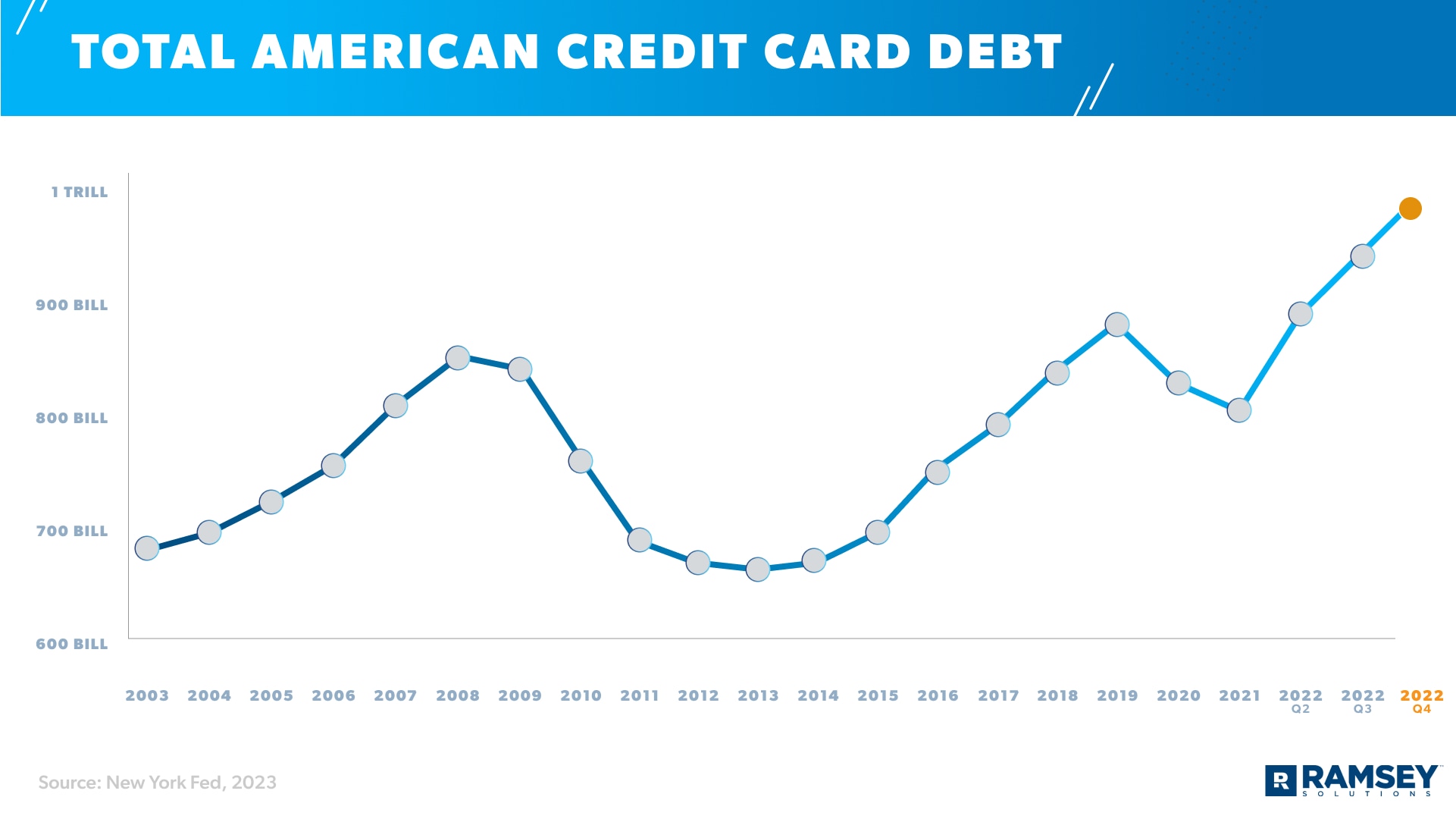

The way most people have been getting by these last few years, is by buying things on credit.

The economy started to really take off after Trump's second year in office... everyone was making more money after the Trump tax cuts... and people were paying off their debt. But as soon as 2021 hit, inflation skyrocketed, and people had to buy things on credit.

This chart sucks... it really does:

EDIT: Apparently, it's currently $1.18 trillion now (up from 2022 in the chart above, where it had hit 1 trillion for the first time). Trump is proposing an interest rate cap, but of course Congress would need to act on this... not sure how it would work because interest rates are often a certain amount off prime, but I'm sure they could figure something out: https://www.cnn.com/2024/09...-card-cap/index.html[This message has been edited by 82-T/A [At Work] (edited 11-27-2024).]

|

|

|

Patrick

|

NOV 27, 11:11 PM

|

|

| quote | Originally posted by 82-T/A [At Work]:

But as soon as 2021 hit, inflation skyrocketed, and people had to buy things on credit.

|

|

And of course, a world-wide pandemic had nothing to do with that.

|

|

|

|