|

| THIS DEBATE IS ACTUALLY GOING TO MEAN SOMETHING (Page 6/22) |

|

olejoedad

|

SEP 07, 06:52 AM

|

|

BS.

We don't have a revenue problem, we have a spending problem.

If there is one member of this Forum that doesn't need perspective on how the government works, it is 82TA.

(BTW, there are several more on here as well)

Save your BS for someone who is gullible.

|

|

|

BingB

|

SEP 07, 01:41 PM

|

|

| quote | Originally posted by olejoedad:

If there is one member of this Forum that doesn't need perspective on how the government works, it is 82TA.. |

|

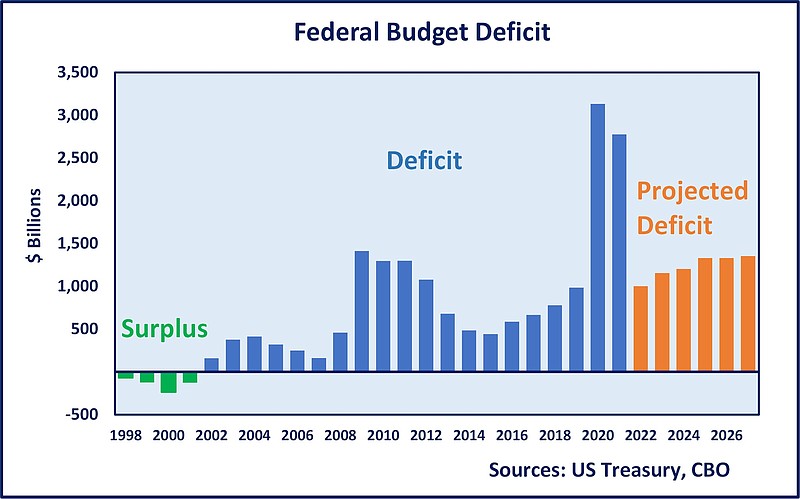

He is completely clueless. He actually claimed that the US ran a government surplus at some point in 2019 when we had a $984 deficit. He claimed that it did not matter that Trump ran deficits twice as large as Obama. He does not understand how any of this works.

|

|

|

BingB

|

SEP 07, 01:47 PM

|

|

| quote | Originally posted by 82-T/A [At Work]:

The Trump Tax cuts resulted in a windfall, producing significantly more tax revenue than the year previously... and continued to do so in the subsequent years.

|

|

The tax breaks COST more then they GENERATED.

That means the government LOST money.

Trump ran much larger deficits than Obama was after he got the economy back on track.[This message has been edited by BingB (edited 09-07-2024).]

|

|

|

82-T/A [At Work]

|

SEP 07, 02:31 PM

|

|

| quote | Originally posted by NewDustin:

Revenues are going to hit all time highs nearly every year...that's how inflation works. To give you some perspective,

What information have you been using to correct him?

|

|

Inflation was 2.49% in 2018.

Inflation was 1.76% in 2019.

Inflation was 1.23% in 2020.

All under the new Trump Tax cuts. Whatever it is you think you're trying to say here, your association is incorrect.

| quote | Originally posted by BingB:

The tax breaks COST more then they GENERATED.

That means the government LOST money

Trump ran much larger deficits than Obama was after he got the economy back on track.

|

|

Once again, you are either intentionally being retarded, or you do not understand the difference between tax revenue and spending deficits.

I've now proven you wrong for the 5th time. You then get embarrassed and try to change what you meant.

YES, Trump increased deficit spending.

THIS HAD NOTHING TO DO WITH THE TRUMP TAX CUTS.

You said this above: "Obviously you are unaware that the Trump administration's unfunded tax cuts cause deficit spending to DOUBLE over the Obama administration even BEFORE covid."

... this is completely incorrect. The Trump Tax Cuts had absolutely nothing to do with this. As a matter of fact... the Trump Tax Cuts made the deficit spending NOT AS BAD as it could have been.

... TRUMP is guilty of passing outrageous spending bills. But that does NOT give you the right to literally make things up by suggesting that the Trump Tax Cuts led to increased deficit spending (which you stated), because that is the EXACT OPPOSITE of the TRUTH.

Again, you're either extremely unintelligent and you can't seem to figure out how this works... or you are hoping I won't catch on.

EVERYONE HERE knows that the Trump Tax Cuts resulted in increased tax revenue.

As Old Joe said... we have a spending problem, not a tax problem.

| quote | Originally posted by BingB:

He is completely clueless. He actually claimed that the US ran a government surplus at some point in 2019 when we had a $984 deficit. He claimed that it did not matter that Trump ran deficits twice as large as Obama. He does not understand how any of this works.

|

|

No, you're misquoting again. I said for the first half the year, we were running a budget surplus.

You are a psychopath. This is your THIRD account on here. You've been banned twice, and you've created a "fake persona" every single time. Never in my life have I ever been so pathetic as to create a fake account, with a completely fake story about my life, to try to give me a "one up" on an internet message forum of about 7 people total.

Here you go Fred/BingB, your one fan on there misse you: I miss Fredtoast's badgering style and may be partly to blame for his banning.[This message has been edited by 82-T/A [At Work] (edited 09-07-2024).]

|

|

|

NewDustin

|

SEP 07, 02:50 PM

|

|

| quote | Originally posted by olejoedad:

BS.

We don't have a revenue problem, we have a spending problem.

If there is one member of this Forum that doesn't need perspective on how the government works, it is 82TA.

(BTW, there are several more on here as well)

Save your BS for someone who is gullible. |

|

I'm not sure what's BS about anything I posted. Those aren't "leftist" sources and I'm not misrepresenting them in any way. I also agree that we have a spending problem. "Gullible" assumes there's a trick here...could you point to it?

The point Todd was making about tax cuts leading to the highest revenue ever absolutely needs perspective. It is true, but so is what I posted. You are free to find whatever source you like, that revenue will set a new record almost every year purely through inflation is demonstrable fact.

I am not assuming that anyone here doesn't know what they are talking about, but we're all guilty of mental biases, and those absolutely cloud your ability to see the entirety of the picture. While Todd does an excellent job of pointing those out in others (he has done so for me), he is still guilty of them himself. I assume he'll take the point I made into consideration, and while it may not change his overall view, he'll examine it and determine what the rational result of that is in the context of his argument. Otherwise, what is the point in engaging in conversation with folks who have a different viewpoint?

Edit: as I post this I see he has done so above  [This message has been edited by NewDustin (edited 09-07-2024).]

|

|

|

NewDustin

|

SEP 07, 03:21 PM

|

|

| quote | Originally posted by 82-T/A [At Work]:

Inflation was 2.49% in 2018.

Inflation was 1.76% in 2019.

Inflation was 1.23% in 2020.

All under the new Trump Tax cuts. Whatever it is you think you're trying to say here, your association is incorrect.

|

|

The article you posted attributed record high revenues to the tax cuts. It ignored that 90% of years over the last 10 years (under Trump and Obama) set a similar record. To claim those tax cuts were responsible for increased revenues or reduced deficits ignores the findings of the CBO and CRS, as well as a large body of reliable evidence. That's what I am trying to say.

Let's back-of-the-napkin math it out:

The inflation rate of the year in question (2017) was 2.13% and revenues that year were $3.32 trillion. That's what...$70 billion dollars in inflated revenue? So if all things remained the same between 2016 and 2017 we would expect a revenue that was $70 billion greater, just to account for inflation, right? If we look at what the actual difference was, it was $3.32 trillion in 2017 and $3.27 trillion in 2016...so $50 billion greater. That's $20 billion less than inflation alone would account for.[This message has been edited by NewDustin (edited 09-07-2024).]

|

|

|

olejoedad

|

SEP 07, 03:42 PM

|

|

| quote | Originally posted by BingB:

He is completely clueless. He actually claimed that the US ran a government surplus at some point in 2019 when we had a $984 deficit. He claimed that it did not matter that Trump ran deficits twice as large as Obama. He does not understand how any of this works.

|

|

Bwahahahaha.

You crack us all up!

Haven't you figured out yet that the ONLY reason anyone reads your posts is for the comedic relief?

|

|

|

BingB

|

SEP 07, 04:38 PM

|

|

| quote | Originally posted by 82-T/A [At Work]:

EVERYONE HERE knows that the Trump Tax Cuts resulted in increased tax revenue.

|

|

They cost more than the revenue they raised. Let me explain.

Business "A" has $1 million in revenue with zero debt.

Business "B" borrowed $2 million dollars in order to generate $1.1 Million in revenue.

Based on your logic business "B" was better off, but that is not the way it works.

Unfunded tax cuts (tax cuts with no spending cuts) are nothing more than borrowing money from the government to put in people's pockets. So of course that will pour gas on the economy and increase revenue. It is the same argument some are using to say that student loan forgiveness will pour gas on the economy and increase revenue.[This message has been edited by BingB (edited 09-07-2024).]

|

|

|

BingB

|

SEP 07, 04:44 PM

|

|

| quote | Originally posted by 82-T/A [At Work]:

No, you're misquoting again. I said for the first half the year, we were running a budget surplus.

|

|

And that is completely false. We had almost a Billion in deficit spending that year and did not have a surplus at any time.

You just make stuff up like that and claim it is true.

|

|

|

82-T/A [At Work]

|

SEP 07, 04:50 PM

|

|

| quote | Originally posted by BingB:

They cost more than the revenue they raised. Let me explain.

Business "A" has $1 million in revenue with zero debt.

Business "B" borrowed $2 million dollars in order to generate $1.1 Million in revenue.

Based on your logic business "B" was better off, but that is not the way it works.

Unfunded tax cuts (tax cuts with no spending cuts) are nothing more than borrowing money from the government to put in people's pockets. So of course that will pour gas on the economy and increase revenue. It is the same argument some are using to say that student loan forgiveness will pour gas on the economy and increase revenue. |

|

NO ONE IS DENYING that Trump increased the Federal deficit.

The problem is, you're saying the tax cuts led to that. They did not... an increase in spending did.

|

|

|

|